In the volatile, meme-powered, and innovation-fueled world of crypto, a strange but powerful phenomenon has emerged: tokens that start from nothing—sometimes dropped for free—can grow into billion-dollar market cap giants in a matter of months.

From Uniswap’s UNI to Arbitrum’s ARB, and more recently, memecoins like PEPE and WEN, crypto has proven that virality can be just as powerful as utility when it comes to token growth.

But how does a token go from airdropped obscurity to market dominance? In this post, we’ll unpack the lifecycle of viral tokens—from launch to moon—and the economic, social, and psychological mechanics that drive their meteoric rise.

1. The Seed: Airdrops, Memes, and Initial Buzz

Most viral tokens begin with zero-dollar entry points—typically through:

- Airdrops: Free distributions to wallets that meet specific criteria (e.g., usage, staking, governance activity).

- Fair launches: No pre-sale or VC involvement; tokens are distributed directly to the public.

- Memes or gimmicks: Tokens like $PEPE and $DOGE launched with no product, just a brand and a narrative that people could laugh at—or identify with.

The goal at this early stage is distribution and attention, not fundamentals. Viral tokens thrive on:

- Simplicity: Easy-to-understand narratives (“the people’s token”).

- Low friction: Anyone can claim or buy in.

- Memeability: The more sharable the concept, the more likely it is to trend.

Case Study: Arbitrum’s ARB Airdrop

In March 2023, Arbitrum’s token was airdropped to early users of its Layer 2 network. It immediately became one of the most traded assets, with a market cap soaring past $1B. Why?

- Mass user base

- Clear utility (governance, ecosystem rewards)

- Strong branding and expectation built in advance

2. The Growth Engine: Community + Hype + Listings

Once a token has launched, what happens next determines whether it sinks into obscurity or rockets upward.

The most important factor in early-stage growth is community energy. Tokens that go viral often have communities that:

- Create memes, videos, and tutorials

- Shill (promote) the token across Twitter, Telegram, Reddit, etc.

- Rally around a collective identity (e.g., the “SHIBArmy”)

This creates a flywheel effect:

- More attention brings more buyers

- Price increases, which leads to even more attention

- Media coverage and influencer interest reinforce the cycle

At this point, early exchange listings—especially on DEXes like Uniswap or PancakeSwap—fuel speculation. When centralized exchanges (CEXes) like Binance, Coinbase, or OKX list the token, it often triggers the “Coinbase effect”, where prices spike due to increased accessibility and credibility.

3. Liquidity and Speculation: The Real Rocket Fuel

Price action and liquidity are key ingredients in a token’s viral explosion. Retail investors are drawn to:

- Low market cap = big upside potential

- High trading volume = active market

- Easy access through DEXes or popular apps like MetaMask or Trust Wallet

Projects that encourage early liquidity mining or staking incentives can further juice demand. Many memecoins and airdropped tokens offer mechanisms to:

- Lock tokens and earn yield

- Provide liquidity to pools for rewards

- Vote in governance (in the case of DAOs)

Meanwhile, social sentiment—tracked on X (formerly Twitter), Telegram, and YouTube—becomes a dominant driver. Sentiment analysis platforms often show that social volume precedes price movement, not the other way around.

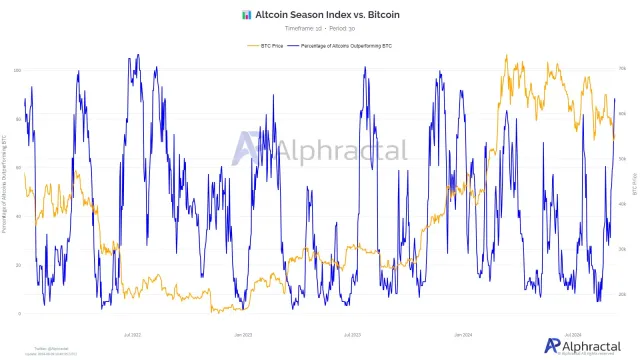

4. The Tipping Point: Crossing the Billion-Dollar Threshold

Reaching a $1 billion market cap is a psychological and narrative milestone. It signals that the token is no longer a joke, but a serious market contender. Investors—especially institutional ones—start to take notice.

Tokens that cross this threshold typically exhibit:

- Strong branding

- Network effects (developers building around the token, partnerships forming)

- CEX support

- Some form of evolving utility or governance roadmap

In many cases, what started as a meme begins to pivot into legitimacy. The team might announce plans for a Layer 2 network, NFT marketplace, or DeFi integration. The line between joke and utility starts to blur.

Case Study: Shiba Inu (SHIB)

Launched as a meme token, SHIB exploded in value after aggressive marketing and listings. Eventually, its developers announced:

- Shibarium, a Layer 2 blockchain

- NFT ecosystem

- Token burn mechanics

These moves helped sustain the token’s narrative long after its initial meme-fueled pump.

5. Sustainability or Decline? The Long-Term Battle

Not every viral token sustains its billion-dollar crown. Many crash as fast as they rise. Key challenges include:

- Lack of real utility

- Over-reliance on hype

- Centralized token allocations or whale sell-offs

- Regulatory concerns (especially for tokens with unclear status)

To sustain momentum, token teams and communities must evolve:

- Build real products around the token

- Create mechanisms for continued token demand (staking, utility in apps, etc.)

- Embrace decentralization and governance

The ones that survive become more than memes—they become platforms.

The Psychology Behind the Virality

Let’s not forget the human side. Viral token growth isn’t just about tech. It’s about emotion and behavior:

- FOMO (Fear of Missing Out)

- Tribal identity

- Hope for life-changing gains

- Participating in an inside joke

- The thrill of gambling wrapped in community

These psychological levers are powerful. When combined with liquidity and social media amplification, they can turn a token from airdrop to unicorn in weeks.

Final Thoughts: Lessons for Investors and Builders

The rise of viral tokens teaches us that value in crypto is social before it’s technical. Hype can launch a project—but sustained growth requires evolution. As we look toward the rest of 2025, here are a few takeaways:

- For investors: Don’t underestimate community energy. It’s often the best early indicator of momentum.

- For builders: If your token is gaining traction, prepare to evolve quickly. Viral status is fleeting without substance.

- For skeptics: Not every viral token is a scam—some are stepping stones toward real innovation.

In crypto, virality is more than a buzzword—it’s a growth strategy. And when executed right, it can turn free airdrops into billion-dollar movements.