If you’ve been trading crypto long enough to remember when gas fees cost more than your coffee, you’ll appreciate what’s happening with Ethereum right now. The network’s Layer-2 ecosystem is exploding, staking is evolving, and institutional money is pouring in like it’s Black Friday on Wall Street. So, is ETH heading for $5,000? Let’s break it down.

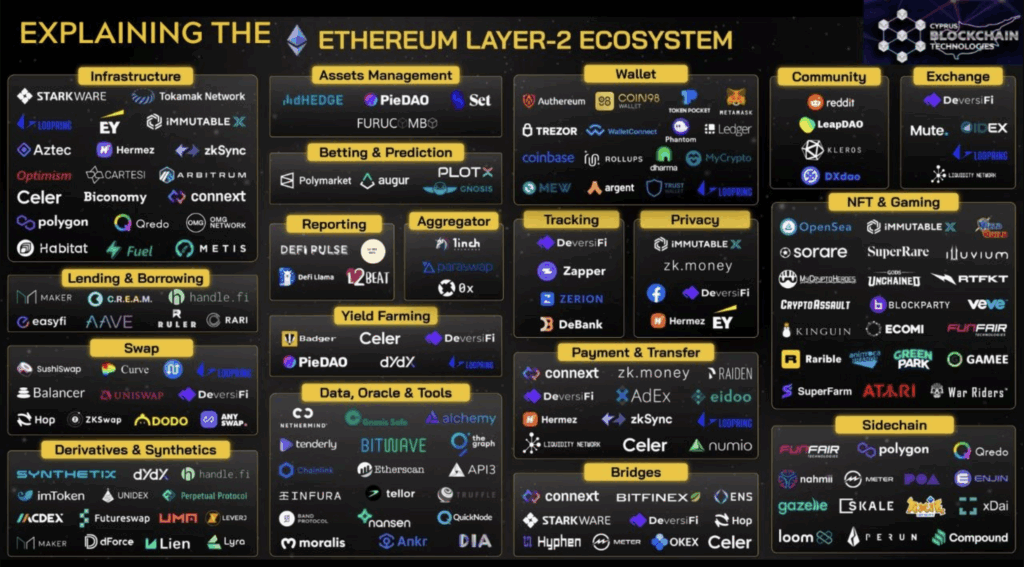

Scalability Upgrades: Ethereum Gets a Speed Boost

Ethereum’s July 2025 upgrades have turned the network into a high-speed freeway. Thanks to rollups and modular scaling, transaction capacity has increased 17-fold, and fees have dropped by over 90%.

| Upgrade | Impact on ETH Network |

| Fusaka | Cheaper L2 transactions, better data availability |

| Pectra | Improved interoperability and validator efficiency |

| Base Rollup | Handles 40% of Ethereum’s traffic, secures $42B in DeFi |

| Decentralized Sequencers | Removes single points of failure, boosts resilience |

Vitalik Buterin himself said Layer-2s in 2025 have “reached key decentralization milestones,” scaling Ethereum’s throughput and slashing fees. That’s not just tech talk—it’s the foundation for mass adoption.

Staking Trends: Institutions Are Locking In

Staking isn’t just for DeFi degens anymore. In July alone, 876,000 ETH was staked by institutions, representing 0.9% of total supply. That’s a big vote of confidence.

| Staking Method | Market Share | Notes |

| Liquid Staking | 31.1% | Dominated by Lido, ether.fi rising |

| Centralized Exchanges | 24.0% | Coinbase, Binance losing ground |

| Restaking Protocols | 6.6% | EigenLayer leads with $12B TVL |

But it’s not all sunshine and yield. Bernstein warns of withdrawal delays, smart contract risks, and liquidity traps. So if you’re staking, diversify and audit your protocols like your portfolio depends on it—because it does.

Institutional Adoption: ETH Goes Corporate

Ethereum ETFs are having a moment. July saw $4.39 billion in inflows, with BlackRock’s ETHA crossing $10B AUM7. That’s not retail FOMO—that’s institutional conviction.

| Company | ETH Holdings | Strategy Highlights |

| BTCS Inc. | 70,028 ETH | Staking + validator infrastructure |

| SharpLink Gaming | 360,807 ETH | Largest corporate holder, earns staking rewards |

| Bit Digital | 120,300 ETH | Pivoted from BTC to ETH, citing yield and utility |

Even Tesla’s rumored ETH treasury play has traders buzzing. And with ETF inflows outpacing Bitcoin’s, the narrative shift is real.

Price Forecast: Can ETH Hit $5K?

ETH is currently trading around $3,810, up 57% in 30 days. With ETF momentum, staking yield, and Layer-2 scaling, analysts are eyeing $5,000 by Q4—and some even whisper $10K if the stars align.

| Forecast Source | Target Price | Rationale |

| Arthur Hayes | $10,000 | Institutional rotation from BTC |

| Bernstein | $6,000–$8,000 | ETF inflows + staking rewards |

| CryptoNewsZ | $5,000 | Technical breakout + ETF demand |

Final Thoughts

Ethereum isn’t just scaling—it’s maturing. With Layer-2s firing on all cylinders, staking evolving into an institutional strategy, and ETFs rewriting the playbook, ETH is no longer the underdog. It’s the infrastructure of the future.

So, will it hit $5K? If you ask me—as a trader who’s seen more charts than sunsets—it’s not a matter of if, but when.