Altcoins, or alternative cryptocurrencies to Bitcoin and Ethereum, have always had an exciting and turbulent relationship with the broader crypto market. From massive surges during bullish cycles to significant crashes in bear markets, altcoins embody the volatility and risk inherent in the cryptocurrency ecosystem. However, as the industry matures and shifts into 2025, it’s clear that the most promising altcoins are evolving—some from the shadows of their previous struggles and others from the rise of emerging trends in blockchain technology.

In this blog post, we will analyze the fall of altcoins in the wake of the 2022–2024 market downturn, the reasons behind the crashes, and the factors driving their potential rise in 2025. More importantly, we’ll explore which altcoins are most likely to see strong growth in the coming year, fueled by both technology developments and market cycles.

The Fall of Altcoins: The Bear Market Blues

The crypto market went through a brutal downturn after the all-time highs reached during 2021. Following Bitcoin’s meteoric rise past $60,000 and the DeFi and NFT frenzy that accompanied the bull market, altcoins were riding high. But when the bear market hit in 2022, altcoins found themselves sinking into a sea of losses, with many of the top altcoins by market cap experiencing significant drawdowns.

Reasons Behind the Altcoin Downturn

Several factors contributed to the drastic fall of altcoins over the past few years:

- Regulatory Crackdowns

Governments across the globe began tightening their grip on cryptocurrency markets. From stricter KYC and AML requirements to growing tax obligations and fears over central bank digital currencies (CBDCs), altcoins were caught in the crosshairs. This regulatory uncertainty created a risk-averse environment, pushing investors toward Bitcoin and Ethereum, both of which were seen as safer bets. - Overvaluation and Hype

In the bull market, many altcoins were pushed to unsustainable highs due to hype, speculation, and the hype-driven behavior of retail investors. When the market corrected, these overvalued altcoins were hit hardest, as investors rushed to liquidate their holdings to preserve capital. - Market Sentiment and Economic Factors

With the global economy facing inflation, interest rate hikes, and recession fears, traditional markets—along with cryptocurrencies—were heavily impacted. This led to reduced institutional investment and a risk-off mentality, where investors turned away from the high-risk assets associated with altcoins. - The Maturing of Blockchain Technology

A focus on tech fundamentals in blockchain shifted investor interest from speculative altcoins to projects that were solving real-world problems and showing tangible results. This left projects without clear use cases or genuine technological progress falling out of favor.

The Resurgence: What’s Driving the Rise of Altcoins in 2025?

As we move into 2025, altcoins are showing signs of recovery, spurred by a new combination of technological innovation, market maturation, and emerging trends. The market is shifting away from speculative mania and towards blockchain-based utility and sustainable ecosystems.

Key Factors Driving the Recovery of Altcoins:

- Institutional Adoption and Integration

2025 marks a pivotal year where traditional institutions are embracing blockchain technology. Financial giants are increasingly integrating cryptocurrencies and blockchain solutions into their business models. This includes tokenized assets, blockchain-based supply chain management, and decentralized finance (DeFi) products that offer yields better than traditional finance options. - Focus on Real-World Utility

As the market matures, utility-focused altcoins are gaining attention. These coins are no longer just about speculative trading. Projects like Chainlink (LINK), Polkadot (DOT), and Solana (SOL) are tackling real problems, such as interoperability, smart contract scaling, and decentralized storage. The next wave of growth will be driven by real-world applications, such as decentralized finance (DeFi), Web3 adoption, and enterprise solutions. - Blockchain Interoperability

One of the significant challenges facing blockchain networks has been interoperability—the ability of different blockchains to communicate with one another. As projects like Cosmos (ATOM) and Polkadot improve cross-chain communication, more altcoins are going to be in demand as businesses look for solutions that can bridge disparate blockchain ecosystems. This need for interoperability solutions is going to fuel growth for many altcoins. - Decentralized Finance (DeFi) and Yield Farming

DeFi has shown immense promise in recent years, and altcoins that facilitate DeFi applications are poised for growth. Layer 2 solutions like Arbitrum and Optimism, along with DeFi protocols like Aave and Compound, are becoming integral parts of the decentralized finance ecosystem. These altcoins stand to benefit from the expanding DeFi use cases as traditional financial systems continue to seek ways to integrate blockchain technology. - NFTs and Gaming Tokens

Non-fungible tokens (NFTs) and blockchain-based gaming have become huge drivers of blockchain adoption. Axie Infinity (AXS), Decentraland (MANA), and Enjin Coin (ENJ) represent altcoins that have integrated NFTs, gaming, and virtual economies into their ecosystems. As the metaverse and digital asset ownership grow in popularity, expect altcoins tied to NFTs and gaming to see significant upside in 2025. - Environmental and Energy-Saving Technologies

Sustainability is a major concern for the cryptocurrency market. Projects that focus on energy-efficient consensus mechanisms, like Cardano (ADA) and Algorand (ALGO), are well-positioned to rise as eco-conscious investors and regulators increasingly prefer green energy solutions. These altcoins are benefitting from a shift in investor priorities, as blockchain technology moves toward environmentally sustainable solutions.

Altcoins Poised for Gains in 2025

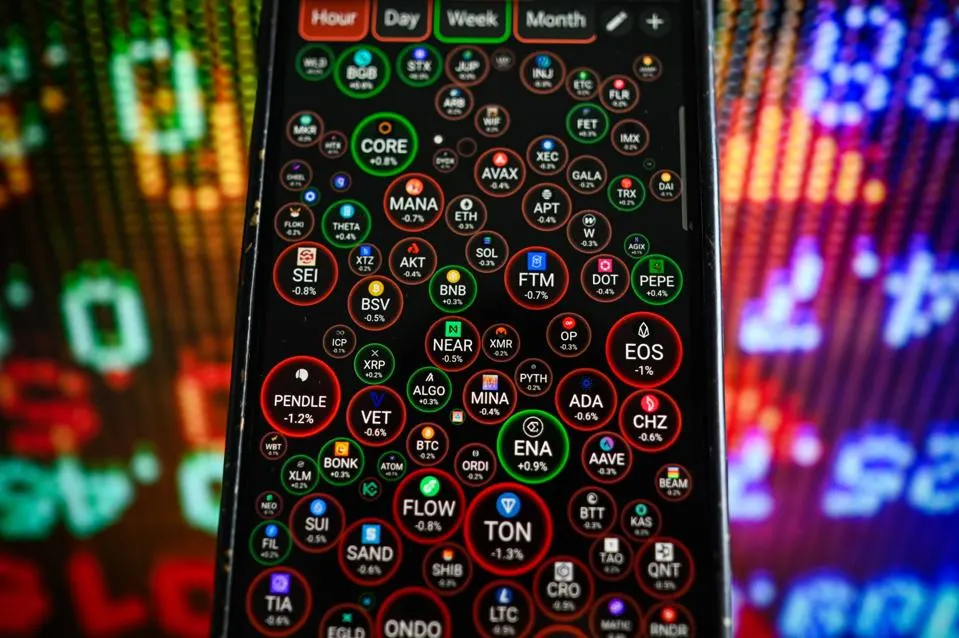

With these factors in mind, here’s a list of some of the altcoins poised for gains in 2025 based on their technology, community, and market demand.

1. Polkadot (DOT)

Polkadot remains one of the leading platforms for blockchain interoperability. With the ability to connect multiple blockchains, Polkadot is positioned to thrive as the demand for cross-chain solutions grows. The completion of key milestones in its roadmap, like parachains, is expected to push DOT’s price upward in 2025.

2. Solana (SOL)

Solana has faced challenges with network outages and technical issues, but it remains one of the fastest and most scalable blockchains. If it can solve its scalability and network stability issues, Solana could see a resurgence in 2025 as more developers and projects build on its platform.

3. Chainlink (LINK)

Chainlink is a key player in smart contract automation and decentralized oracles, connecting real-world data to blockchains. As DeFi and blockchain applications become more mainstream in 2025, Chainlink’s ecosystem will grow, making LINK a strong contender for significant price appreciation.

4. Cosmos (ATOM)

Cosmos is another major player in the blockchain interoperability space. Its vision of creating an “Internet of Blockchains” is gradually taking shape, and demand for its technology will likely increase as developers look for cross-chain solutions in 2025.

5. Aave (AAVE)

Aave has solidified itself as one of the leading DeFi lending platforms. With the DeFi space growing, Aave’s innovative lending and borrowing protocols will continue to attract users. As DeFi adoption expands, AAVE is likely to see significant growth.

6. Avalanche (AVAX)

Avalanche has gained traction due to its high throughput, low fees, and decentralized finance capabilities. As more decentralized apps and DeFi projects launch on Avalanche’s network, AVAX has the potential to rise sharply in 2025.

Final Thoughts: A Bright Future for Altcoins?

Altcoins have been through a rough few years, but 2025 looks promising for those with real-world utility and strong community support. While speculation will always be part of the altcoin ecosystem, the next generation of altcoins will likely be driven by fundamental use cases, interoperability, and the growing influence of decentralized finance, NFTs, and blockchain gaming.

As the regulatory environment stabilizes and institutions begin to embrace blockchain technology more seriously, we can expect to see more mature and sustainable projects come to the forefront. The future of altcoins in 2025 and beyond may not be about chasing hype—it will be about adoption, innovation, and building for the long-term.

Are you ready to explore the next generation of altcoins? Let’s dive into the comments and discuss which tokens you think are poised for the next big move!